Bitcoin, the first decentralized digital currency, has a rich history that spans over a decade. From its origins in the cypherpunk movement to its impact on the financial world, Bitcoin has revolutionized the way we think about money and transactions. In this article, we will explore the history of Bitcoin, its early adoption and growth, its impact on the financial world, regulation and legal challenges, its role in society, and its future and challenges. Here are the key takeaways:

Key Takeaways

- Bitcoin was introduced by an unknown person or group of people using the pseudonym Satoshi Nakamoto in 2008.

- Bitcoin operates on blockchain technology, a decentralized ledger that records all transactions in a transparent and immutable manner.

- Bitcoin’s price has experienced significant volatility over the years, but it has also emerged as a store of value and an alternative to traditional banking.

- Bitcoin has faced regulatory challenges and legal scrutiny in various countries, with governments responding differently to its existence.

- Bitcoin has the potential to empower individuals by providing financial inclusion, enabling remittances, and challenging traditional financial systems.

The Origins of Bitcoin

The Cypherpunk Movement

The Cypherpunk Movement, which emerged in the 1980s, played a significant role in the development of Bitcoin. Cypherpunks were a group of activists advocating for the widespread use of strong cryptography and privacy-enhancing technologies. They believed that individuals should have the right to protect their privacy and communicate securely without interference from governments or corporations.

One of the key ideas promoted by the Cypherpunks was the concept of digital cash, which would enable anonymous and decentralized transactions over the internet. This idea laid the foundation for the creation of Bitcoin, which aimed to provide a peer-to-peer electronic cash system that operates without the need for intermediaries.

The Cypherpunk Movement’s emphasis on privacy and decentralization aligns closely with the principles of Bitcoin. It is believed that many early Bitcoin adopters and contributors were influenced by the ideas and discussions within the Cypherpunk community.

The Creation of Bitcoin

The creation of Bitcoin marked a significant milestone in the history of cryptocurrency. It was established by the pseudonymous entity known as Satoshi Nakamoto, the mysterious creator of Bitcoin. The Genesis Block, mined by Nakamoto on January 3, 2009, served as the foundation for this revolutionary digital currency. Within the Genesis Block was a message from The Times: ‘Chancellor on brink of second bailout for banks.’ This message highlighted the decentralized philosophy of Bitcoin and acted as a symbolic demonstration against the established banking system.

The Genesis Block not only initiated the Bitcoin Blockchain but also set the stage for a peer-to-peer electronic cash system. It represented a shift away from centralized banking institutions and introduced a decentralized network where consensus was achieved through cryptographic proof-of-work. This groundbreaking innovation allowed for financial transactions online without anyone controlling or stopping them.

The Genesis wallet, originally containing 50 mined bitcoins, has received an increase in funds from the global Bitcoin community over the years. As of 2023, the balance in the Genesis wallet reached 72 bitcoins. The latest transaction has further boosted the balance to 99.67 bitcoins, valued at $4.3 million. It is speculated that Nakamoto not only created Bitcoin but also mined numerous blocks during the early days of the network’s existence. The exact number of blocks mined by Nakamoto remains unknown.

The creation of Bitcoin and the Genesis Block laid the foundation for a financial revolution. It challenged the traditional banking system and introduced the concept of decentralized finance. Today, Bitcoin and the underlying blockchain technology continue to shape the future of finance and have paved the way for the development of other cryptocurrencies. The impact of Bitcoin’s creation extends far beyond its initial launch, and its influence on the financial world continues to evolve.

The Identity of Satoshi Nakamoto

The true identity of Satoshi Nakamoto, the creator of Bitcoin, remains a mystery. Over the past fifteen years, many individuals have claimed to have solved this mystery, with several identities being proposed by publications like Newsweek, Forbes, The New York Times, and others. However, all claims have thus far been denied. Some prominent candidates include Hal Finney, a pre-Bitcoin cryptographic pioneer, decentralized finance enthusiast Nick Szabo, Australian academic Craig Wright, and Finnish economic sociologist Dr. Vili Lehdonvirta. Despite the speculation, the true identity of Satoshi Nakamoto has never been confirmed.

Early Adoption and Growth

The First Bitcoin Transactions

On January 12, 2009, the first Bitcoin transaction took place when ten Bitcoins were sent to a developer. This transaction marked the beginning of a new era in digital currency. It demonstrated the potential of Bitcoin as a decentralized form of payment, allowing for direct transactions between parties without the need for intermediaries like banks. This transaction also highlighted the anonymity of Bitcoin, as the identity of the sender and recipient remained unknown. Since then, Bitcoin has gained widespread adoption and has become a popular investment asset and means of online payment.

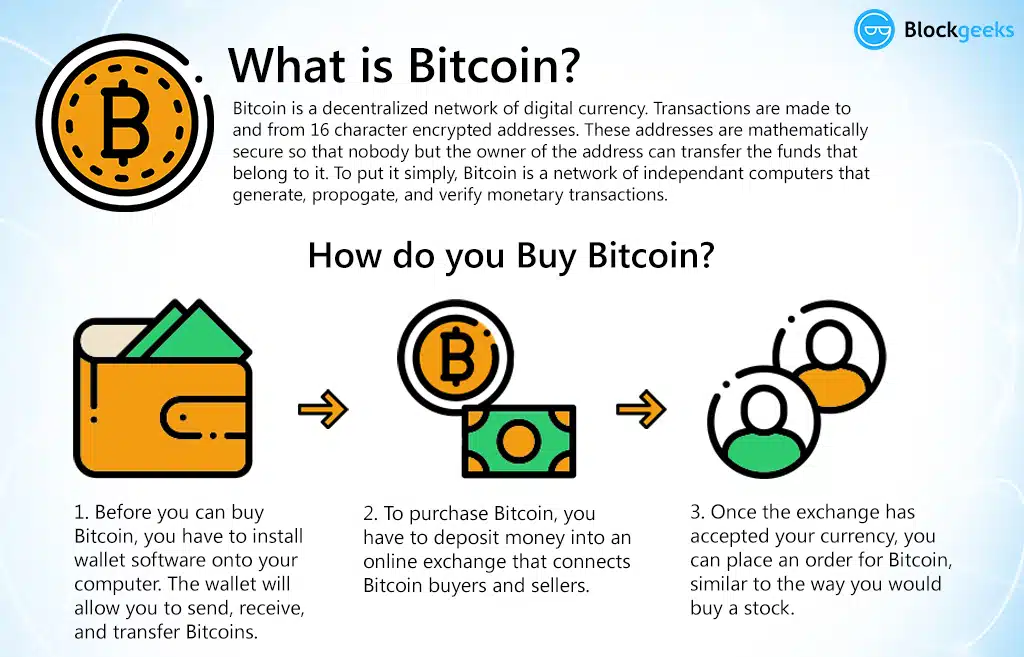

Bitcoin Exchanges and Wallets

Bitcoin exchanges and wallets play a crucial role in the world of cryptocurrencies. These platforms facilitate the exchange of digital currencies and provide users with tools to monitor market trends and make informed trading decisions. Popular cryptocurrency exchanges and trading platforms like Binance, Coinbase, Kraken, and Bitstamp offer a variety of trading pairs, user-friendly interfaces, and advanced trading features to cater to different levels of expertise. Additionally, Bitcoin wallets serve as secure storage solutions for managing Bitcoins. They come in various forms, including software applications and hardware devices, each offering different levels of convenience and security. Safeguarding your private key is of utmost importance in protecting your cryptocurrency assets.

Bitcoin Mining and the Blockchain

Bitcoin mining is a foundational process in the cryptocurrency ecosystem, employing high-powered computing to unlock new bitcoins and validate transactions. Miners race to solve complex cryptographic puzzles, securing the network and earning rewards in the form of bitcoins and transaction fees. The efficiency and profitability of this process are dynamically regulated by the protocol’s difficulty adjustment mechanism. The blockchain records the change in difficulty, ensuring the average block creation time of 10 minutes and maintaining the immutability and integrity of the data. Mining and consensus are key mechanisms that uphold the integrity and security of the blockchain.

Bitcoin’s Impact on the Financial World

Bitcoin’s Volatility and Price Movements

Bitcoin is known for its price volatility. Understanding the factors that influence Bitcoin’s price and the role of supply and demand dynamics is crucial for anyone interested in this digital currency.

Several factors contribute to the volatility of Bitcoin’s price, making it a unique and unpredictable asset:

- Market Sentiment: Bitcoin’s price is highly sensitive to market sentiment and investor perception. News, events, and regulatory actions can significantly impact the cryptocurrency’s price.

- Global Economic Factors: Bitcoin’s price is often influenced by global economic conditions. In times of economic uncertainty or turmoil, investors may turn to Bitcoin as a hedge against traditional financial markets.

- Liquidity and Trading Volume: The level of liquidity and trading volume in cryptocurrency exchanges can impact the value of Bitcoin. Higher liquidity can result in more efficient price discovery and reduce the potential for significant price swings.

Understandably, Bitcoin’s price is influenced by a combination of factors, including market sentiment, global economic conditions, liquidity, and investor behavior. Understanding the dynamics of supply and demand is crucial in comprehending Bitcoin’s value. As the cryptocurrency market continues to evolve, so too will the drivers of Bitcoin’s price volatility.

Bitcoin as a Store of Value

Bitcoin has gained recognition as a store of value, similar to gold or other traditional assets. Its limited supply and decentralized nature make it an attractive option for investors looking to diversify their portfolios. The value of Bitcoin has experienced significant volatility over the years, with its price reaching new highs and lows. However, many believe that Bitcoin’s potential for long-term growth outweighs its short-term price fluctuations.

Some advantages of investing in Bitcoin as a store of value include:

- Potential for high returns: Bitcoin has shown the potential for substantial price appreciation over time. Investors who bought Bitcoin early on have seen significant returns on their investment.

- Hedge against inflation: Bitcoin’s limited supply and decentralized nature make it resistant to inflationary pressures. As a result, some investors view Bitcoin as a hedge against traditional fiat currencies.

- Portability and accessibility: Bitcoin can be easily transferred and accessed through digital wallets, making it a convenient store of value for individuals around the world.

It’s important to note that investing in Bitcoin carries risks, and individuals should carefully consider their risk tolerance and investment goals before entering the market. As with any investment, it’s advisable to do thorough research and seek professional advice when necessary.

Bitcoin’s Influence on Traditional Banking

Bitcoin has emerged as a groundbreaking digital currency that is disrupting traditional financial systems and industries. Here are the key takeaways and potential future developments in the world of Bitcoin:

- Decentralization and Financial Freedom: Bitcoin’s decentralized nature allows individuals to have complete control over their funds without relying on intermediaries such as banks. This promotes financial freedom and empowers individuals to make transactions without geographic or institutional limitations.

- Transparency and Security: Bitcoin’s blockchain technology ensures the transparency and security of transactions, making it a reliable alternative to traditional banking systems.

- Disintermediation: Bitcoin eliminates the need for intermediaries in financial transactions, reducing costs and increasing efficiency.

- Innovation and Financial Inclusion: Bitcoin has paved the way for innovative financial products and services, such as decentralized finance (DeFi), that provide access to financial services for individuals who are unbanked or underbanked.

- Potential Challenges: While Bitcoin offers numerous benefits, it also faces challenges such as scalability issues and competition from other cryptocurrencies. Additionally, the role of central banks in the future of Bitcoin remains uncertain.

Clearly, Bitcoin’s influence on traditional banking is transforming the way we think about money and financial transactions. It offers individuals greater control, transparency, and innovation in the digital economy.

Regulation and Legal Challenges

Government Responses to Bitcoin

When it comes to regulating Bitcoin, different countries have taken varying approaches. While some nations have embraced cryptocurrencies and developed supportive regulations, others have imposed strict restrictions or even banned their use altogether. For example, the United States has taken a proactive approach towards regulating Bitcoin, with various federal agencies providing guidelines and regulations. The Financial Crimes Enforcement Network (FinCEN) requires Bitcoin exchanges and certain businesses dealing with cryptocurrencies to register as Money Services Businesses (MSBs) and comply with anti-money laundering (AML) and know-your-customer (KYC) requirements. On the other hand, China has adopted a more restrictive approach, banning initial coin offerings (ICOs) and shutting down domestic cryptocurrency exchanges. Bitcoin mining has also faced scrutiny in China, with the government taking steps to limit energy consumption and environmental impact. Japan, on the other hand, has emerged as one of the most Bitcoin-friendly countries, legalizing Bitcoin as a method of payment and introducing a licensing system for cryptocurrency exchanges to promote consumer protection and prevent money laundering. These examples illustrate the diverse approaches taken by governments globally, and it is important for Bitcoin users and businesses to familiarize themselves with the specific regulations in their jurisdiction to ensure compliance.

Bitcoin and Money Laundering

Bitcoin has faced scrutiny and criticism due to its potential use in money laundering activities. Governments around the world have implemented regulations and measures to address this concern. For example, the United States has taken a proactive approach by requiring Bitcoin exchanges and certain businesses dealing with cryptocurrencies to register as Money Services Businesses (MSBs) and comply with anti-money laundering (AML) and know-your-customer (KYC) regulations. Other countries have also introduced similar regulations to prevent money laundering and promote consumer protection.

Compliance and reporting requirements for Bitcoin users and businesses vary depending on the jurisdiction. Failure to comply with these requirements could lead to penalties or legal consequences. Businesses that accept Bitcoin as a form of payment or hold it as an asset may have additional reporting obligations, such as disclosing the value and nature of cryptocurrency holdings in financial statements. Many countries also require Bitcoin exchanges and businesses to implement robust AML and KYC procedures, including verifying the identity of customers and reporting suspicious activities.

The establishment of clear regulations can enhance Bitcoin’s acceptance and stability. Governments are exploring regulatory frameworks to address concerns regarding consumer protection, money laundering, and tax evasion. Financial institutions are also starting to explore ways to integrate Bitcoin into their existing systems, bridging the gap between traditional finance and cryptocurrencies. As Bitcoin continues to evolve, enhancements in privacy and anonymity are being explored to address privacy concerns associated with pseudonymous transactions. Overall, the regulation of Bitcoin and its integration into traditional financial systems play a crucial role in shaping its future and ensuring its legitimacy.

Bitcoin’s Legal Status in Different Countries

Bitcoin’s legal status varies across different countries. While some nations have embraced cryptocurrencies and developed supportive regulations, others have imposed strict restrictions or even banned their use altogether. For example, the United States has taken a proactive approach towards regulating Bitcoin, with various federal agencies providing guidelines and regulations. The Financial Crimes Enforcement Network (FinCEN) requires Bitcoin exchanges and certain businesses dealing with cryptocurrencies to register as Money Services Businesses (MSBs) and comply with anti-money laundering (AML) and know-your-customer (KYC) requirements.

These examples illustrate the diverse approaches taken by governments globally. It is important for Bitcoin users and businesses to familiarize themselves with the specific regulations in their jurisdiction to ensure compliance. Compliance and reporting requirements for Bitcoin users and businesses continue to evolve as the regulatory framework surrounding Bitcoin develops.

- AML and KYC Regulations: Many countries require Bitcoin exchanges and businesses to implement robust AML and KYC procedures.

- Licensing Systems: Some countries have legalized Bitcoin as a method of payment and introduced a licensing system for cryptocurrency exchanges to promote consumer protection and prevent money laundering.

It is crucial for individuals and businesses operating in the cryptocurrency space to stay informed about the evolving legal and regulatory landscape around the world.

Bitcoin’s Role in Society

Bitcoin and Financial Inclusion

Bitcoin has emerged as a groundbreaking digital currency that is disrupting traditional financial systems and industries. Here are the key takeaways and potential future developments in the world of Bitcoin:

- Decentralization and Financial Freedom: Bitcoin’s decentralized nature allows individuals to have complete control over their funds without relying on intermediaries such as banks. This promotes financial freedom and empowers individuals to make transactions without geographic or institutional limitations.

- Transparency and Security: Bitcoin’s blockchain technology ensures transparency and security in transactions, making it a reliable and trustworthy system.

- Regulatory Frameworks: As Bitcoin continues to gain popularity, governments around the world are exploring regulatory frameworks to address concerns regarding consumer protection, money laundering, and tax evasion. The establishment of clear regulations can further enhance Bitcoin’s acceptance and stability.

- Integration with Traditional Financial Systems: Many financial institutions are starting to explore ways to integrate Bitcoin into their existing systems. This integration can bridge the gap between traditional finance and the world of cryptocurrencies, enabling seamless transactions.

- Global Adoption: While some nations have embraced cryptocurrencies and developed supportive regulations, others have imposed strict restrictions or even banned their use altogether. The United States, for example, has taken a proactive approach towards regulating Bitcoin, with various federal agencies providing guidelines and regulations.

Essentially, Bitcoin has the potential to revolutionize financial inclusion by providing individuals with greater control over their finances, promoting transparency and security, and bridging the gap between traditional finance and the world of cryptocurrencies.

Bitcoin’s Use in Remittances

Sending Bitcoin as remittance eliminates the need for intermediaries, such as banks and remittance services, which often charge high fees. This allows individuals to send money directly to their loved ones in a faster, more cost-effective manner. With the use of Bitcoin, remittance recipients can convert the received Bitcoin into fiat currency, ensuring quick access to funds without hefty conversion fees.

Bitcoin’s practical applications in the real world are expanding across various sectors. From e-commerce and cross-border transactions to remittances, Bitcoin offers advantages such as lower transaction fees, faster settlement times, enhanced privacy and security, and simplified international transfers. As Bitcoin continues to gain mainstream acceptance, its practical use in remittances is becoming increasingly popular.

In regions with limited banking infrastructure, traditional money transfers can be expensive and time-consuming. Bitcoin, on the other hand, allows for nearly instant and low-cost transfers across borders. Additionally, Bitcoin’s decentralized network ensures transparency and reduces the risk of currency fluctuations, making it an attractive option for individuals and businesses engaged in international trade.

Sending Bitcoin as remittance not only provides a faster and more cost-effective solution but also empowers individuals by giving them direct control over their funds. This can be particularly beneficial for individuals in developing countries who rely on remittances as a source of income. By leveraging Bitcoin’s technology, individuals can bypass traditional financial systems and access their funds more efficiently.

Bitcoin’s use in remittances offers a disruptive alternative to traditional money transfer methods. It provides individuals with a faster, more affordable, and secure way to send money across borders. As the adoption of Bitcoin continues to grow, its impact on the remittance industry is likely to increase, benefiting individuals and communities worldwide.

Bitcoin’s Potential for Empowering Individuals

Bitcoin has emerged as a groundbreaking digital currency that is disrupting traditional financial systems and industries. Here are the key takeaways and potential future developments in the world of Bitcoin:

- Decentralization and Financial Freedom: Bitcoin’s decentralized nature allows individuals to have complete control over their funds without relying on intermediaries such as banks. This promotes financial freedom and empowers individuals to make transactions without geographic or institutional limitations.

- Transparency and Security: Bitcoin’s blockchain technology ensures transparency and security in transactions. The decentralized nature of the blockchain makes it difficult for any single entity to manipulate or control the system, providing a level of trust and security for users.

- Potential for Economic Inclusion: Bitcoin has the potential to empower individuals who are unbanked or underbanked, providing them with access to financial services and opportunities that were previously unavailable to them. This can help bridge the economic gap and promote financial inclusion.

- Innovation and Disruption: Bitcoin has sparked a wave of innovation and disruption in various industries. From the development of new financial products and services to the exploration of blockchain technology in other sectors, Bitcoin has opened up new possibilities and challenges the status quo.

Bitcoin’s potential for empowering individuals is immense. Its decentralized, transparent, and secure nature, along with its potential future developments, make it an exciting and evolving force to watch out for in the world of finance. As technology continues to advance, Bitcoin is poised to play a significant role in shaping the future of global economies.

Bitcoin’s Future and Challenges

Scalability Issues and the Lightning Network

Bitcoin’s scalability has been a major concern due to its limited processing capacity. To address this issue, several solutions have been proposed:

- Segregated Witness (SegWit): This protocol upgrade separates transaction signatures, allowing more transactions to fit into a block. It increases the block size limit and reduces transaction fees.

- Lightning Network: The Lightning Network is a layer-two scaling solution that enables instant and low-cost transactions by creating bi-directional payment channels. It relieves the main blockchain of excessive transaction volume.

- Increasing Block Size: Another proposed solution is to increase the block size limit to accommodate more transactions.

These solutions aim to improve Bitcoin’s scalability and enhance its transaction capacity. By implementing these upgrades, Bitcoin can become more efficient and capable of handling a larger number of transactions.

Competition from Other Cryptocurrencies

While Bitcoin was the first and most well-known cryptocurrency, there are now a multitude of alternative cryptocurrencies, also known as altcoins. These altcoins offer different features, functionalities, and use cases compared to Bitcoin. Some popular altcoins include Ethereum, Ripple, Litecoin, and Bitcoin Cash. Ethereum, for example, is known for its smart contract capabilities, allowing for the creation of decentralized applications (DApps) on its blockchain. Ripple, on the other hand, focuses on providing faster and more cost-effective cross-border transactions. As the popularity of cryptocurrencies continues to grow, it’s important to explore alternative options and innovations that go beyond Bitcoin. This includes considering altcoins and their unique offerings, as well as advancements in blockchain technology that can improve scalability, security, and efficiency. It’s an exciting time for the cryptocurrency market, with new projects and developments constantly emerging. However, with increased competition and the need for sustainable solutions, the Bitcoin community must adapt and evolve to remain relevant in the ever-changing landscape of cryptocurrencies.

The Role of Central Banks in the Future of Bitcoin

As Bitcoin continues to gain popularity, governments around the world are exploring regulatory frameworks to address concerns regarding consumer protection, money laundering, and tax evasion. The establishment of clear regulations can further enhance Bitcoin’s acceptance and stability.

Integration with Traditional Financial Systems: Many financial institutions are starting to explore ways to integrate Bitcoin into their existing systems. This integration can bridge the gap between traditional finance and the world of cryptocurrencies, enabling seamless transactions.

Conclusion

In conclusion, the history of Bitcoin is a fascinating journey that began with the release of Satoshi Nakamoto’s whitepaper in 2008. Since then, Bitcoin has revolutionized the global financial landscape and captured the attention of investors and the general public. With its decentralized nature and innovative blockchain technology, Bitcoin has paved the way for the development of other cryptocurrencies and has the potential to reshape the way we handle money and finance. While Bitcoin has made significant strides in the past fifteen years, there is still much room for growth and widespread adoption. As the cryptocurrency market continues to evolve, it will be interesting to see how Bitcoin and other digital currencies shape the future of finance.